Blog

05.Sep.2025

The Next Evolution: Where Is Supplement Demand Heading in 2026?

Introduction

Global demand for dietary supplements is entering a new era. As consumers prioritize health, prevention, and personalized nutrition, brands and manufacturers must foresee what’s next. This article unpacks the supplement demand forecast for 2026—covering market size, top growth segments, emerging consumer insights, and actionable strategies to seize the next wave of wellness innovation.Supplement Market Size and Growth Projections

- The worldwide dietary supplement market will reach $203.4B in 2025 and is projected to nearly double—to $402.2B—by 2034, averaging 8.5% CAGR.

- Functional supplement sales will see over $13B in additional annual revenue by 2026, with online channels and e-commerce driving unprecedented growth.

- Vitamins continue their dominance, but specialty supplements (collagen, pre- and probiotics, fiber, nootropics) are growing fastest, while sports nutrition leads in growth rate at 8.4% year-over-year.

Consumer Insights: What’s Driving Supplement Demand?

1. Preventive Health and Immunity

- Immune health supplements are set to top $27.6B by 2026, with double-digit growth across vitamins, minerals, and herbal extracts.

- Consumers are proactively managing health—pre-pandemic habits persist, with gut and respiratory support high on shopping lists.

2. Plant-Based and Vegan Supplement Revolution

- The plant-based segment is projected to rise from $27.5B in 2025 to $42.3B by 2030 at 9% CAGR.

- Demand for clean label, ethically sourced, and vegan protein (algae, pea, hemp) is driving product launches and reformulations.

3. Personalized Nutrition and Smart Supplementation

- Personalized supplement platforms—using AI or DNA analysis—will reach $8.1B by 2026, forecasted at 10.7% CAGR.

- Custom nutrient stacks and solutions for sleep, stress, cognition, or exercise recovery highlight a shift away from “one-size-fits-all”.

4. Gut Health and Microbiome Innovations

- Sales of prebiotics, probiotics, and synbiotics are expected to add $4.7B more by 2028, growing 7.3% per year.

- Consumers see gut health as central to immunity, mood, and skin, driving demand for advanced, science-backed digestive blends.

5. Clean Label, Sustainability, and Transparency

- 50% of consumers worldwide will pay more for supplements with clean labels and visible sustainability certifications.

- Traceability and eco-friendly packaging—biobased, recycled, or compostable—are must-haves for premium shelf presence and repeat buyers.

Trending Categories for 2026

| Category | Growth Rate | Key Drivers |

| Sports Nutrition | 8.4% Y-o-Y | Performance, recovery, hydration |

| Specialty Supplements | 6.3% Y-o-Y | Collagen, fiber, pre/pro/synbiotics |

| Meal Replacements | 5.7% Y-o-Y | Weight management, convenience |

| Herbs/Botanicals | 5.4% Y-o-Y | Adaptogens, stress/mood, sleep |

| Vitamins/Minerals | 2.7–4.1% Y-o-Y | Immunity, deficiency prevention |

| Plant-Based Proteins | 9% CAGR | Sustainability, vegan/clean label |

| Personalized Nutrition | 10.7% CAGR | AI-driven, custom health solutions |

Sports nutrition and specialty products will bring in the highest incremental value, while vitamins remain foundational but slow-growing.

Delivery Formats and Consumer Preferences

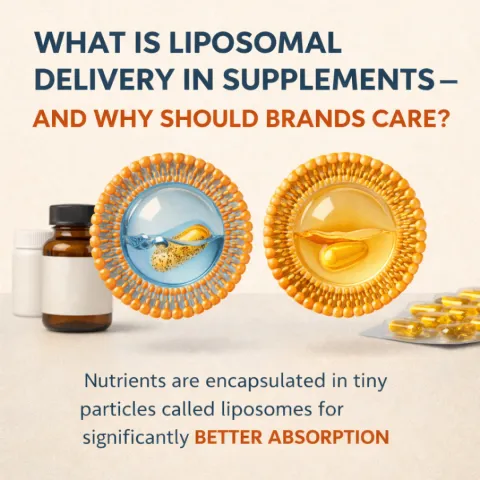

- New Formats: Chewables, fast-melts, effervescents, functional drinks, and stick packs are gaining market share due to pill fatigue and swallowing difficulty.

- Convenience: Capsules, tablets, and powders remain popular, but single-serve, portable options (stick packs, shots) are rising—especially among young, urban, and active consumers.

- Direct-to-Consumer/Online: Online supplement sales are set to double by 2033, making digital platforms, subscription models, and influencer marketing key success levers.

Market Drivers: Technology, Regulation, and Innovation

- Tech Transformation: AI-powered platforms recommend supplements, monitor compliance, and deliver user insights, shaping product innovation and personalization.

- Regulatory Shifts: Quality standards and claim substantiation are stricter, but policies supporting supplement innovation will drive market expansion.

- Sustainability Investments: Sourcing, manufacturing, and packaging practices aligned to global eco standards help brands win new consumer segments.

“As supplement demand accelerates, brands must deliver efficacy, transparency, and personalization—while adopting the latest in science and digital engagement. The winners will be those who anticipate evolving needs and adapt quickly.”— Patrick Brueggman, CEO & President, Vitaquest

Regional Demand Trends

- Asia-Pacific: Largest growth region (especially China, India, Southeast Asia); sports, collagen, gut health, and herbal supplements are leading sales.

- North America: High penetration of immune health, vitamins, and vegan products. Personalized nutrition subscriptions thriving.

- Europe: Sustainability, traceability, and clean label certifications drive demand. Plant-derived and gut health solutions especially popular.

FAQs on Supplement Demand Forecast

Q: Which supplement types will see the highest demand in 2026?A: Expect explosive growth in gut health, sports nutrition, plant-based proteins, personalized stacks, and convenient formats.

Q: Why are consumers spending more on clean label and personalized supplements?

A: Concerns about efficacy, purity, ingredient sourcing, and wanting tailored products for fitness, mental health, or age-specific needs.

Q: How can brands capture the rising demand?

A: Innovate with trending ingredients, leverage tech for personalization, build transparency into supply chains, and focus on user experience in both product and digital channels.

Conclusion

Supplement demand in 2026 will be shaped by consumer pursuit of preventive health, real science, personalized solutions, and eco-conscious choices. Brands that embrace innovation, understand segment-specific drivers, and align digital-first strategies with transparency will not only meet expectations but capture new market opportunities.Stay Ahead Your Competitors

Download the full trend report or connect with our supplement specialists for forecast-driven launch and category strategies.