Blog

18.Sep.2025

Top Ingredients Consumers Will Pay Premium For in 2025–2026

Introduction

The supplement industry is evolving fast—and consumers are driving up the value of specific, high-quality ingredients. Research reveals that more than 70% of shoppers in the US, Europe, and Asia willingly pay a premium for supplements with branded, clinically proven, or highly-recognized ingredients. As 2025 and 2026 approach, key ingredient trends—from collagen and plant-based proteins to adaptogens and nootropics—are transforming category leaders and shaping how brands build trust, set prices, and win shelf space.Why Consumers Pay a Premium: The Ingredient Recognition Effect

Recent global surveys show that ingredient recognition is now a top driver of purchase decisions and pricing power:supplysidesj+1- 73% of consumers are willing to pay higher prices for supplements made with trusted, recognizable ingredients—44% in the US say they’ll pay up to 75% more.

- Asian consumers (India, Philippines, Malaysia) also value branded ingredients, with over a quarter willing to pay a significant premium.

- The ability to “see and recognize nutrition information on-pack” outranks even taste and price for many shoppers.

- Studies connect willingness-to-pay (WTP) to organic, clean-label, and functional claims—especially for ingredients perceived as clinically potent.pmc.ncbi.nlm.nih+1

Collagen: The Beauty and Longevity Phenomenon

Collagen remains among the fastest-growing and most “premiumized” ingredients worldwide:- In Europe and Asia-Pacific, collagen is a leading add-on for “beauty-from-within,” anti-aging, and joint support.

- Marine and vegan collagens command 25–40% higher price points, especially when paired with hyaluronic acid, elastin peptides, or antioxidants.

- Consumers seek proven benefits for skin elasticity, hydration, and visible results. Clean-label, third-party tested collagen sources are particularly in demand.

Plant-Based Proteins and Specialty Amino Acids

Plant protein ingredients—especially pea, rice, and fermented blends—are experiencing a surge thanks to sustainability, ethical concerns, and allergy avoidance:- APAC regions report 25–30% annual growth in vegan/plant-based supplement options through 2026.

- Consumers increasingly request traceability, organic certification, and “complete profile” proteins.

- Specialty aminos and peptides (BCAAs, glutamine) remain popular for sports, recovery, and metabolic wellness.

Adaptogens, Botanicals & Functional Mushrooms

Adaptogenic ingredients are a premium segment as stress and mood support become core wellness goals:- Ashwagandha, Rhodiola, Holy Basil, and Lion’s Mane are the most sought-after adaptogens and functional mushrooms for their “balancing” and anti-fatigue effects.

- Brand managers and formulators are pairing these with classic herbal extracts (turmeric, ginger, saffron) to create premium price tiers and multi-functional products.

- Rhodiola rosea, Bacopa monnieri, and mushrooms like Lion’s Mane are crossing into nootropics territory, blurring lines between mental and physical wellness.nutraceuticalbusinessreview

Nootropics: Cognitive & Mood Support in the Mainstream

Nootropics are the fastest-growing segment for premium supplement ingredients:- Ingredients such as Bacopa monnieri, sage, Rhodiola, and Lion’s Mane are top picks for students, professionals, and “brain wellness” shoppers.

- Theanine, magnesium, and postbiotics also support this function, often featured in beauty and immune health blends for added consumer appeal.

- Strong clinical studies and patent-protected delivery formats give brands authority—and command double-digit price premiums.

Postbiotics, Probiotics, and Gut Wellness

Gut health remains a fundamental wellness driver:- Next-gen postbiotics offer greater stability and expanded delivery formats over probiotics, making them ideal for tailored, functional nutrition.

- Zinc, echinacea, elderberry, and time-release vitamin C/NAC are highly desired as immune resilience pairings.

- Top brands combine gut, immune, mood, and metabolic support in multi-ingredient blends—and price them as “premium stacks.”

Premium Minerals: Bisglycinate and Chelated Formats

Mineral bioavailability and absorption matter:- Magnesium bisglycinate and amino acid-chelated minerals are favored for their superior uptake and minimal digestive side effects.

- These formats are being marketed with clear “absorption advantage” stories and target segment claims—men, women, seniors, active lifestyles.

- Clear communication and scientific substantiation builds price permission in mature supplement markets.

Immune, Beauty, and Longevity Blends

Multi-functional, high-efficacy blends are increasingly popular—and command a premium:- Beauty-from-within combos (collagen + hyaluronic acid + antioxidants) are leaders in the category.

- Longevity blends now feature spermidine, resveratrol, and NMN—branded ingredients with clinical studies drive premium positioning.

- Consumers pay more for packaged “skin + immunity + metabolism” solutions, particularly if tablets, gummies, or liquids are science-backed and palatable.vitaquest+2

Clean Label, Sustainability, and Transparency: The New Standard

75% of supplement buyers will pay extra for clean label and eco-friendly ingredients—especially among Millennials and Gen Z:- Organic, certified sustainable, and traceable supply chains are top trust drivers, pushing price premiums up to 40% for certain ingredients.

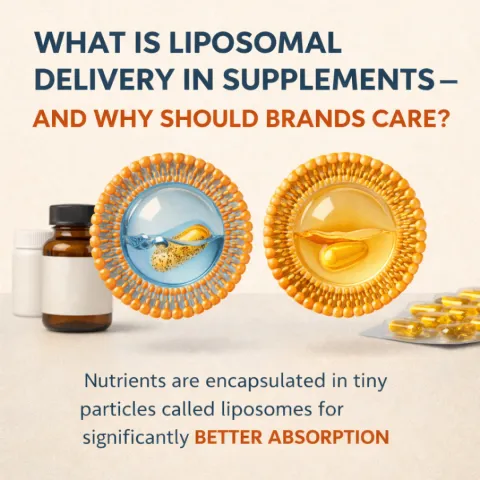

- Time-release and advanced delivery systems (microencapsulation for vitamin C, multi-phase probiotics) resonate with discerning buyers seeking higher efficacy.

- Brands benefit from “ingredient storytelling”—showcasing sourcing, evidence, and user results in marketing content.

Table: Top Premium Supplement Ingredients 2025–2026

| Ingredient/Class | Demand Driver | Willingness to Pay Premium | Notable Brands/Trends |

| Collagen (Marine/Vegan) | Beauty, joint, longevity | 25–40% higher | Skin, anti-aging, hydration blends |

| Plant Protein (Pea, Rice) | Vegan, sustainability | 15–30% higher | Sports, meal replacement, RTDs |

| Adaptogens (Ashwagandha, Lion’s Mane) | Stress, mood | 20–50% higher | Gummies, powder stacks, nootropics |

| Magnesium Bisglycinate | Absorption, gut health | 20–35% higher | Sleep, stress, active lifestyles |

| Nootropics (Rhodiola, Bacopa) | Cognitive, mood | 30–50% higher | Students, gamers, multitaskers |

| Postbiotics/Probiotics | Gut, immunity | 20–40% higher | Multi-benefit blends, sticks |

| Branched-Chain Aminos | Sport, recovery | 15–25% higher | Strength, muscle, hydration RTDs |

| Beauty/Immunity blends | Multi-functional | 25–45% higher | Hair, skin, immunity, mood support |

Consumer Insights & Market Quotes

"Our research shows the main purchase drivers for supplements in 2025–2026 are ingredient recognition, perceived clinical efficacy, and clean label storytelling."— Neil Cary, Market Research Consultancy"We're seeing consumers accept 25–50% price premiums for formulas with vegan collagen, plant protein, and branded adaptogens or nootropics—especially if they're backed by published results and influencer testimonials."— DTC Supplement Brand Manager, Vitafoods Europe Interviewevolutagency

Frequently Asked Questions (FAQ)

Q: Do branded ingredients really justify higher prices?A: Yes—ingredients with clinical studies, patents, or consumer recognition can double typical price points and drive loyalty.

Q: Which supplement delivery formats are trending for premium products?

A: Gummies, powders, and liquid shots—especially those targeting beauty, immune, and brain wellness—are growing fastest.

Q: How important is sustainability for premium supplement buyers?

A: Essential: certified organic, eco-friendly, and traceable ingredients power long-term premium demand, especially in North America and developed APAC.

Conclusion

Consumers in 2025–2026 are more ingredient-savvy—and more willing to pay—than ever. Brands investing in high-efficacy, clinically-proven, and recognizable premium supplement ingredients will not only capture demand, but also long-term loyalty and category leadership. To thrive, innovate your supply chain, communicate your story, and deliver the science and trust consumers crave.Ready to upgrade your supplement portfolio?

Contact our team for the latest ingredient sourcing insights and branding best practices—turning premium components into premium growth.